Credit Score Meaning, Credit Rating, Ways to Improve a good credit score

Credit Score Meaning

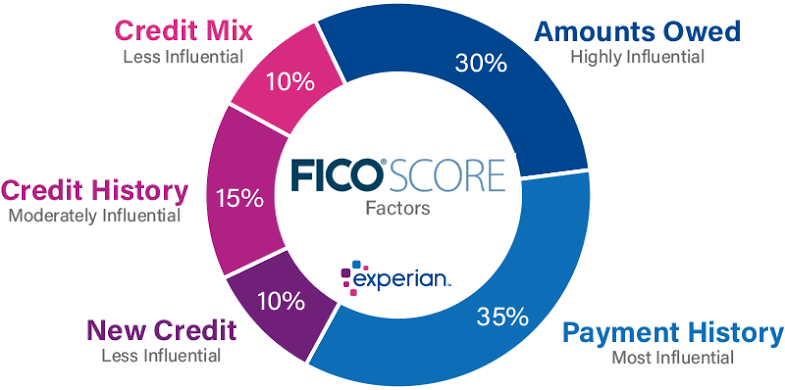

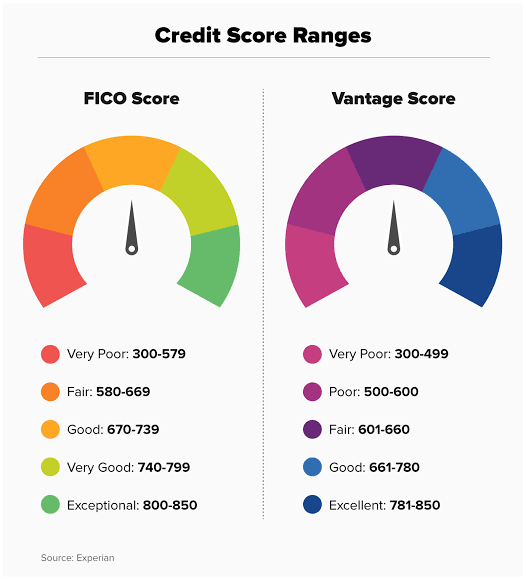

A credit score is a number that states a consumer’s creditworthiness, credit behavior and how likely the consumer will pay back the loan in due time. The Credit score is calculated using the Fair Isaac Corporation (FICO), the FICO is a three-digit number that range from 300 – 850, and it helps to accurately state a consumer’s credit profile.

Credit Score FICO credit rating

The generally acceptable FICO credit score ratings are shown below.

300 – 579 : Poor

580- 669 : Fair

670 – 739 : Good

740 – 799 : Very Good

800- Above : Excellent

Ways to build a good credit score

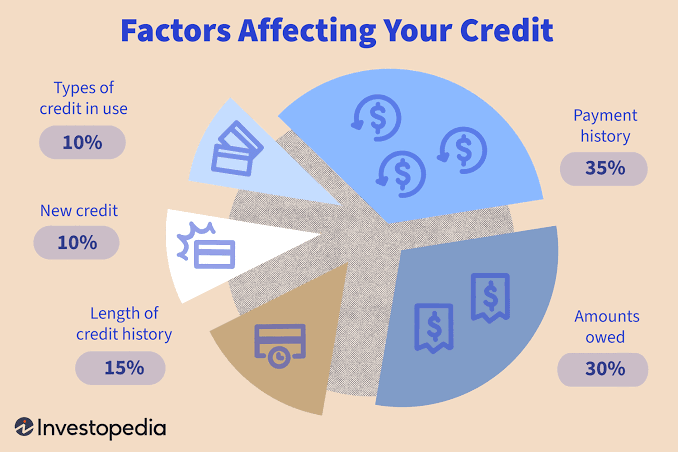

1. Repaying your Loans Promptly

One of the best ways to improve your credit rating is timeliness of repaying loans. If you repay your loans as at when due without defaulting it generally improves your credit score greatly.

2. Don’t Exhaust your Loan/Credit Limit

Avoid using 100% of your approved Loan/Credit Limit. Ensure that you use 70% – 80% of your approved loan, this in turn will greatly improve your credit rating.

3. Good Credit/Loan History

If a consumer has a good credit history with consistent and timely repayment of loans and experience. It creates a robust credit history and performance of the consumer.

4. Apply for the Credit/Loan you need

One way to boost a good credit score is to apply for the credit and loan facility you need. Do not take a credit for unnecessary spendings and expenses. Use the credit gotten for a project or a planned business proposal.

Leave a Comment